How to invest in cryptocurrency: a step-by-step guide

Cryptocurrency is not the future — it’s already our reality. Decentralized digital assets are actively traded on major exchanges, and they can be used to pay for shopping and even utility bills. That’s why the question of how to invest in cryptocurrency correctly is relevant for everyone who aims for success and wants to grow their capital.

In this article, I will explain how to choose a cryptocurrency for investment, what altcoins are, and which methods of passive income from digital assets exist. I have also prepared an overview of a leading cryptocurrency investment platform. For beginners, there is a separate section with practical advice.

What are cryptocurrencies?

It’s not entirely correct to equate the terms “cryptocurrency,” “digital currency,” and “digital asset.” Cryptocurrency is a specific type of digital money that exists independently, without a regulator or registrar. This unique status makes it a decentralized financial system. All cryptocurrency transactions are transparent and irreversible.

The main idea behind cryptocurrency is to create a stable system of digital payments for remote purchases of goods and services. The first successful cryptocurrency was Bitcoin, where transaction information was grouped into blocks, and those blocks formed an unbroken chain called the blockchain. Each new block contained processed data from previous ones, while complex algorithms ensured the accuracy of operations within the system.

After Bitcoin, the number of cryptocurrencies began to grow rapidly. Today, there are thousands of them, and all non-Bitcoin digital currencies are called altcoins. They function as independent payment systems and market assets. Altcoins can be stored in digital wallets, exchanged for fiat money, used to buy contracts on exchanges, or to pay for goods, services, and other digital products. Many crypto exchanges issue their own plastic cards that allow payments in offline stores, and in some regions, utility bills can also be settled with cryptocurrency.

Since Satoshi Nakamoto launched Bitcoin in 2009, more and more traders and investors have been exploring how to invest in cryptocurrency. This sector of the global financial market keeps expanding and offers numerous opportunities for both active and passive income. Profits are possible due to high volatility: with accurate forecasting, investors can buy assets at a lower price and sell them at a higher one.

It is wrong to equate the concepts of “cryptocurrency” and “digital currency” or “digital asset”. Cryptocurrency is a special case of digital currency. Its special feature is that it exists completely autonomously, and it has neither a regulator nor a registrar. In other words, this special status constitutes a decentralized monetary system. All transactions using cryptocurrencies are open and irreversible.

How to invest in cryptocurrency for beginners

Beginners have many options to invest in cryptocurrency, and the most obvious way has already been mentioned, which is speculative trading on the price difference. The cost of Bitcoin (₿), Ethereum (Ξ), Litecoin (Ł), and other cryptocurrencies changes literally every minute. So does the value of fiat currencies, energy, securities, and other assets. But cryptocurrencies are many times more volatile because they are decentralized and do not have a single regulatory source. Therefore, almost any factor can affect their price.

Most often, cryptocurrencies are traded among themselves on exchanges. For example, Bitcoin to Ethereum (BTC/ETH) or Bitcoin to Tether (BTC/USDT). But some pairs involve cryptocurrency and fiat. Naturally, the most popular such pair is Bitcoin to the US dollar (BTC/USD). Here the answer to the question of how to correctly invest in cryptocurrency is conceptually simple because it is based on the same principles as when trading regular currencies on Forex. That is, the trader uses the methods of technical and fundamental analysis to predict future market prices and conditions.

For example, at the time of this article, Ξ1 costs US$3.935.89. We will proceed from this figure, giving an example. You can see a pattern on the chart and you can predict that the price will rise to US$4.104.47 during the day. Then you buy some amount of Ethereum and then sell it at its peak. The difference between the price of the asset at the time of purchase and the price at the time of sale is your profit.

If you already own a certain amount of cryptocurrency, you may want to start investing passively. That is, to make money not on trading an asset, but on its investment. One of the most popular options is staking. In simple terms, you provide your assets to the blockchain system to keep it running and in return, you receive a fixed percentage of profit.

If you go into details, then new blocks in the blockchain can be created by providing computing power to mine the cryptocurrency. This is the classic mining method to build new blocks during which you do not need calculations, but only existing coins. This is called Proof of Stake (PoS). Based on this, the more coins you transfer, the more your final reward will be.

Staking, as an investment in cryptocurrency, is more energy-efficient and environmentally friendly than mining because you don’t need powerful graphics cards, processors, and an abundant supply of electrical power. You only need an intermediary service through which you provide your assets within the selected blockchain. Quite a lot of well-known cryptocurrencies operate on the PoS system, for example, Solana, Cardano, Tezos, and Algorand. Ethereum plans to switch to it soon. This means that there is no doubt about the prospects of the method.

What cryptocurrency to invest in and how to buy Bitcoin

Bitcoin is the correct answer to the first question, but it’s not the only one. Bitcoin was the first successful cryptocurrency. The development of the protocol was completed in 2009, at the same time Satoshi Nakamoto published the code of the client program. The price of Bitcoin is constantly increasing. If at the time of creation it cost a fraction of a cent, then at its peak in 2023 the price reached US$69,000.

In the Russian Federation, the Law on Digital Financial Assets and Digital Currencies is currently in force. According to this law Bitcoin and altcoins are prohibited from being used to pay for goods or services, but they can be an investment facility.

For those who decided to start investing in digital assets, Ethereum (or Ether) can be also very attractive. It is not a payment system like Bitcoin. Ethereum was conceived as a platform for launching decentralized online services. This altcoin appeared in 2014, and today the cost of one Ethereum is ₽290,843.83 (RUB) (~US$3,900.41). It has the second market rank, that is, it follows directly behind Bitcoin. Ethereum has a market dominance rate of 21.07%.

When thinking about which cryptocurrency in which to invest, you don’t have to focus on the market leaders. Many other popular altcoins are profitably traded on exchanges and allow you to earn passively. For example, Cardano (ADA), Ripple (XRP), Dogecoin (Doge,Ð), and Polkadot (DOT). Binance Coin (BNB) is worth mentioning separately. It is the coin of the crypto exchange of the same name, it is not only in demand in the cryptocurrency market, but also gives its holders a discount on commission fees when trading on Binance.

Which cryptocurrency to invest in: Tips for beginners

Tip 1. Look at the popularity of the coin in the blockchain community. If a coin is present on leading cryptocurrency exchanges and reputable publications include news about it in their feeds, it is a promising digital asset.

Tip 2. The in-demand cryptocurrencies are supported by e-wallets. Not every digital asset can be stored on such wallets. But if the asset supports most of the services, it is popular and there will be no problems with moving it between accounts.

Tip 3. Before you start investing, track the quote history of the selected cryptocurrency. This is easy to do by typing the corresponding query into a search engine. If the price of an asset grows in the long term (excluding general drawdowns), you can work with it.

Tip 4. When Ethereum switches to PoS, the emission will decrease by 2.5% and the coin will become profitable for long-term storage. Ether also provides the dApp to work. Beginners need to choose cryptocurrencies that are constantly evolving and are part of large projects.

Tip 5. Take advantage of the Traders Union’s ratings and articles about cryptocurrencies on the portal. Our experts carry out in-depth analyses of the world’s digital assets and provide competent, objective advice.

Top 10 altcoins for investment

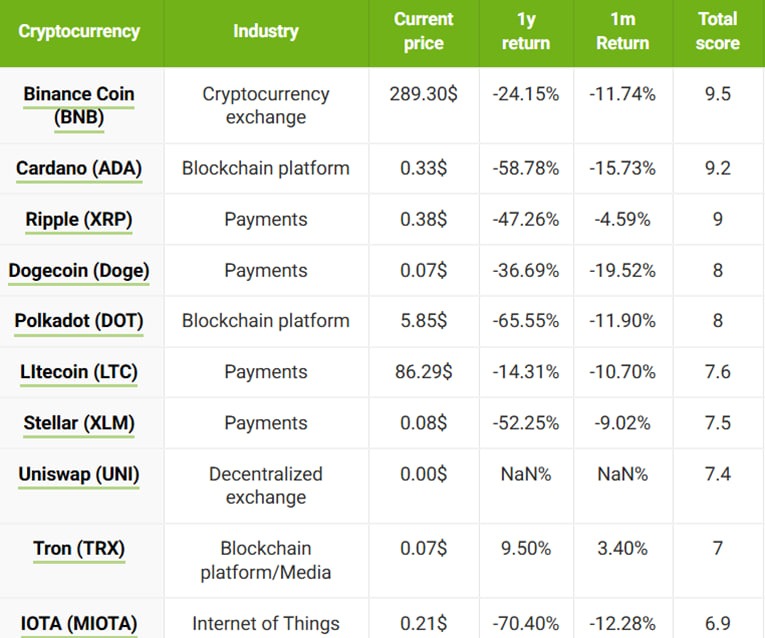

Often, the question of which cryptocurrency to invest in is solved by the choice of an altcoin. As was said, altcoins are any cryptocurrency other than Bitcoin. At the moment, there are almost 3,000 altcoins, not every one is promising. The table below shows those that are advantageous to invest in right now.

Best platform for investment and your personal finance

By now you may already have a general idea of how to correctly invest in cryptocurrency. Choosing a crypto exchange is key because you will trade and stake on its terms. By the sum of the factors, the Traders Union’s experts offer the Binance crypto exchange as a top option. Binance was launched in 2017 and is headquartered in Hong Kong. The exchange works with residents of all countries without regional restrictions. The service is translated into 26 languages, and customer service supports 11 languages.

Key features and benefits: The crypto exchange offers classic and advanced trading, leveraged (margin) trading, and derivatives including futures and options. Fees are below average in the segment of 0.1% for a taker/maker on a spot. There is a built-in P2P exchange service, as well as a fast cryptocurrency purchase service. You can pay directly by credit card, bank transfer, and from other crypto wallets. There are excellent guides for beginners. In terms of passive earnings, the platform has introduced a unique comprehensive Binance Earn solution with different staking options.

Another advantage of Binance is the previously mentioned BNB token. First, it is a popular token that is actively traded. Second, holding it in the account reduces the commission for spot trading by 25% and the commission for trading futures by 10%.

How to invest in crypto currency: step-by-step guide

It’s time to show you how to invest in cryptocurrency. For example, TU will use the Binance crypto exchange to explain to you step by step what you need to do to register, fund your account, analyze the market, and start trading.Step1: Registration

Go to the official Binance website; your region will be automatically detected. If it didn’t happen, select a region in the upper right corner. Then click the “Registration” button. Select “Create personal account”, enter your email, and create a password. You will receive a confirmation code by email. Enter it in the appropriate field.

Next, you need to specify your phone number; a verification code will be sent to it. After confirming the number, you will find yourself in your personal account. Note that for some regions, only one confirmation is sufficient — either email or mobile phone. You may also need to go through a simple anti-bot check.

Step 2: Verification

At the top of your personal account, you will see a notification that you need to verify your personal data. You can go to the verification menu from this notification or by clicking on your account icon in the upper right corner and selecting the “Security” section, and then the “Verification” subsection. Use the type of verification that is optimal for you (they differ in the complexity of confirmation and the final limits on the input/output of fiat), click “Start” and follow the instructions on the screen. You will need to provide scans of identity documents.

Step 3: Funding your account

In the upper right corner, hover over the “Wallet” section, select the “Wallet overview” subsection, or directly select “Fiat and Spot”. Then press the “Enter” button and indicate what you will enter — either fiat or cryptocurrency. For example, click “Enter in Fiat”, specify the currency, amount, and transfer method, such as from a Visa/MC bank card. Immediately you will see the amount of the commission for the transaction. Click “Proceed” and follow the instructions on the screen. You will be redirected to the payment service.

Step 4: Market analysis

Hover your cursor over the “Trade” section, click on the subsection you are interested in, such as, “Classic Trade”. You will find yourself in a terminal where you can select any asset available for trading, for example, a pair of ETH/BTC. On the screen, you will see a chart with a choice of intervals and indicators for technical analysis. You will also have the archive of transactions. At the bottom of the screen, there is a feature for displaying your transactions on the exchange.

Use technical analysis tools to predict quotes (for example, identify patterns on a chart). Methods of fundamental analysis will also help you such as viewing current news. Make transactions in the trading terminal based on forecasting within your trading strategy. By the way, you can download it to your mobile gadget by hovering over the “Applications” in the upper right corner of the screen. Scan the QR code, download the app and follow the onscreen instructions.

Step 5: Purchase cryptocurrency

To open a transaction to purchase the selected cryptocurrency, go to the bottom of the trading terminal. Select the terms of purchase and click “Buy”. You can also purchase cryptocurrency through the P2P exchange service by going to the section of the same name on the website.

Passive income through Binance Earn

Now that you know how to buy cryptocurrency on Binance, you can start investing through the Binance Earn service. To go to it, click on the “Earn” button located in the top menu. Binance Earn is a convenient passive earning method for beginners.

The “Earn” menu contains all digital assets from which you can make money by lending them to blockchain systems. Note that you must have an appropriate asset on your account. You will be given the opportunity, if necessary, to buy the appropriate asset on the exchange, and exchange it for an existing one. Or you can purchase it through a P2P exchange or pay directly from a bank card.

Binance Earn offers three types of deposits - guaranteed (low income, low risk), high yield (high income, high risk), and auto investing according to an individual plan with an adaptive level of income and risk. For each type, there are detailed explanations. For any asset, you can see the period of the deposit, its spot price, and the estimated income in annual interest. To start investing, click “Start Staking” opposite the selected asset, and the system will provide you with information on the existing conditions. Next, you need to select the amount you want to invest and activate cooperation.

Are there any risks in crypto currencies?

You decided which cryptocurrency to invest in, found an exchange with favorable conditions (for example, Binance), and developed your own strategy. But this does not provide any particular guarantees. Observing the rules of money management, diversifying your investment portfolio using the stop limit and additional functions of the trading terminal, you can reduce the risk, but not eliminate it completely.

Cryptocurrencies are extremely volatile, sometimes their quotes change unpredictably. Of course, with experience, you will learn to identify even less obvious patterns and predict trends accurately. But even being a “pundit” of the direction of the market or asset, you cannot always win. You will still lose several bets. This is how the market works.

Staking also has its own risks such as the so-called scam projects. These are fraudulent firms that collect funds from investors and then simply disappear. Staking exchanges scrupulously weed out unreliable partners, but they also cannot completely eliminate risks for investors. Therefore, when deciding to start investing in digital assets, you must be risk-tolerant yet try to minimize risks by all means available to you.

How to correctly invest in cryptocurrency: 5 tips from an expert

Rule 1 – Fortune favors those who are prepared. Read a couple of books on stock trading, such as Benjamin Graham’s The Intelligent Investor. Take some online courses, study an array of guides. You do not need financial education, but you must master the basics of technical and fundamental analysis in order to trade successfully.

Rule 2 – Do not violate the principles of money management. Let us immediately indicate that in trading you cannot use funds you cannot risk losing at the current moment. In the process itself, on average, the rate should be about 2-5% of the deposit amount. There are other principles of money management, they are universal and excellent in reducing risks. Be sure to study them.

Rule 3 – Appeal to reason rather than to feelings. A successful investor is stress-resistant. If you have a hard time with emotional moments (you react aggressively and thoughtlessly), you need to practice and not allow momentary feelings to impact your decisions. Otherwise, failure is guaranteed even with the most successful strategy.

Rule 4 – Diversify your portfolio. The easiest way to reduce your risk is to trade in multiple cryptocurrencies. Then an erroneous forecast with one asset will be leveled by successful forecasts in other directions. If you are stacking, invest in several projects, not just one.

Rule 5 – Perfect yourself. There are no universal strategies. Therefore, your strategy must be flexible. Constantly monitor the market, learn from colleagues, communicate with other traders in the community, immerse yourself in guides. Even passive investing is active to a certain extent.

Summary

Now you know how to select a promising cryptocurrency, how to start investing, and what is needed to be successful. Technically, there is no difficulty, whether it is active trading on the exchange, P2P exchange, or staking. However, this area needs to be studied while being prepared to take risks. Then you can earn and even make investing your main source of income.

Post a comment