Best Forex Strategies for Maximum Profit

The most profitable types of Forex strategies

A Forex trading strategy is a pre-planned approach to trading that includes a set of rules and criteria for making trading decisions. The goal of a strategy is to ensure consistency and discipline in trading, minimize risks, and maximize potential profits.

A strategy can be based on various methods of analysis, including technical, fundamental, or a combination of both. Incorporating elements of capital and risk management is also an essential part of any successful trading strategy.

Trend trading

Trend trading is based on following the current market movement and entering positions in the direction of the trend. This is a popular strategy because of its simplicity and the possibility of generating stable income.

Although this strategy can be implemented just on the basis of price action and trendlines, traders also often use indicators such as moving averages and Awesome Oscillator to determine the strength of a trend and entry and exit points.

Breakout trading

Breakout trading focuses on identifying key support and resistance levels and opening positions when those levels are broken. This strategy involves high volatility and significant potential for profitable trades. Key support and resistance levels along with indicators such as Bollinger Bands and Donchian Channels are often used to identify possible breakout levels.

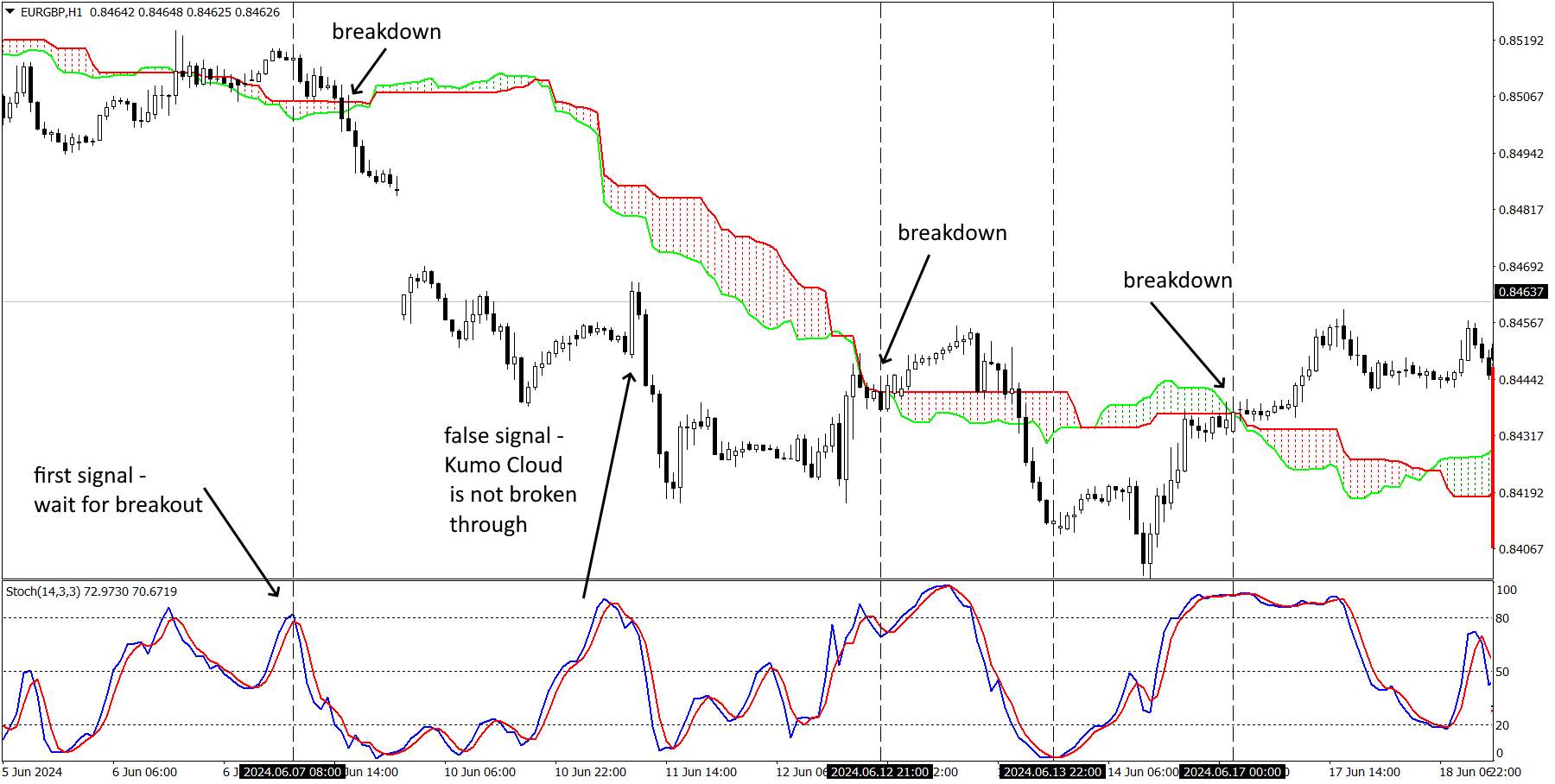

Below is an example of a strategy with a standard breakout interpretation:

Kumo Cloud + Stochastic Strategy

Range trading

Range trading is based on trading within established support and resistance levels, especially in low volatility environments when the market moves sideways. Traders use price channels as well as indicators such as RSI and stochastic to determine entry and exit points at range boundaries.

Forex range trading

Scalping

Scalping involves making quick trades over short periods of time in order to make small profits from each price movement. This strategy requires high responsiveness and access to real-time data. Short-term charts and indicators such as Bollinger Bands are often used for scalping.

Forex scalping

Position trading

Position trading involves long-term trades that can last weeks or months, with an emphasis on fundamental analysis and the use of technical techniques such as Elliott Wave theory to identify market trends and entry points.

Elliott wave theory positional trading

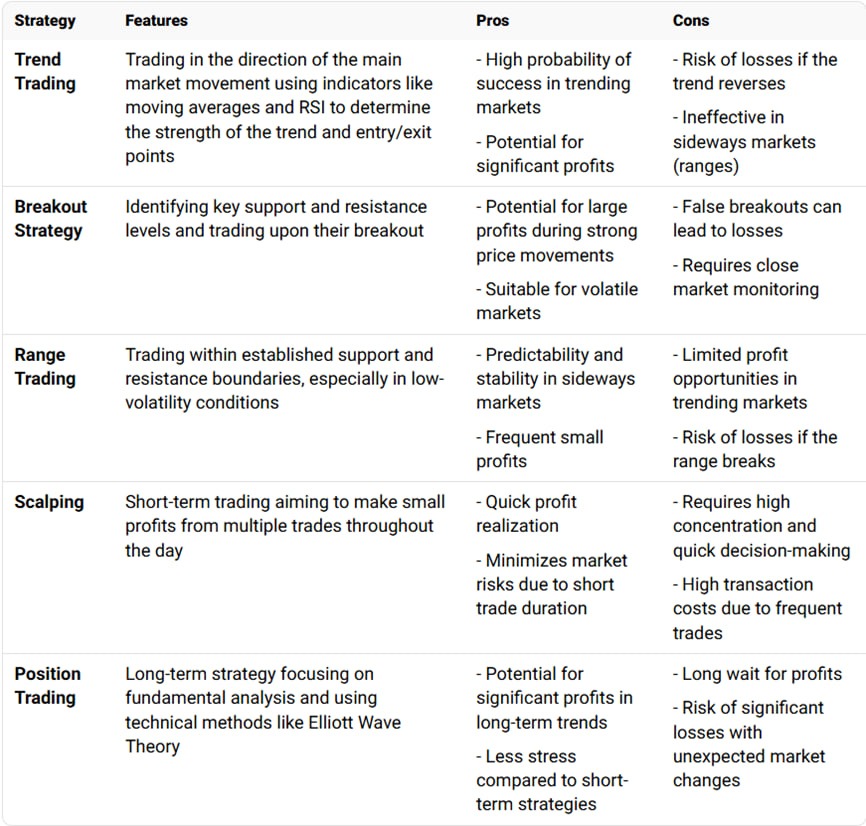

Types of Forex trading strategies, their features, pros and cons

How to choose the most profitable Forex trading strategy

To choose a Forex trading strategy that suits your goals and trading style, focus on several factors:

Determine your trading goals

Before diving into the details of different strategies, it is important to clearly define your trading goals. Do you want to receive a stable income, grow capital or invest for the long term? Understanding your goals will help you determine which strategy is best for your needs. For example, a day trader looking for quick and regular income might prefer scalping, while an investor looking for long-term growth might choose position trading.

Assess your risk tolerance

Each trading strategy carries a certain level of risk. It is important to evaluate how much risk you are willing to take on each trade and in general. High frequency strategies such as scalping may involve less risk per trade, but require great discipline and quick decisions. In contrast, long-term strategies such as trend trading may involve greater risks per trade but can offer significant returns over time.

Testing the chosen strategy

Before risking real money, it is recommended to test your chosen strategy on a demo account. This will allow you to refine your approach, understand its strengths and weaknesses, and gain confidence without the risk of losing money. Most trading platforms offer demo accounts that simulate real market conditions.

Manage risks

Regardless of the strategy, effective risk management is key. Set stop-loss orders to protect against significant losses, and size your position based on your risk tolerance. The general rule is not to risk more than 1-2% of your trading capital on a single trade.

Constantly learn and adapt

The Forex market is dynamic and constant learning is necessary. Follow market news, economic indicators and evolving trading techniques. Be prepared to adapt your strategy in response to changing market conditions.

To read further on choosing the right Forex trading strategies, you can read our article Effective Forex Trading Strategies: Looking for a Winner's Way

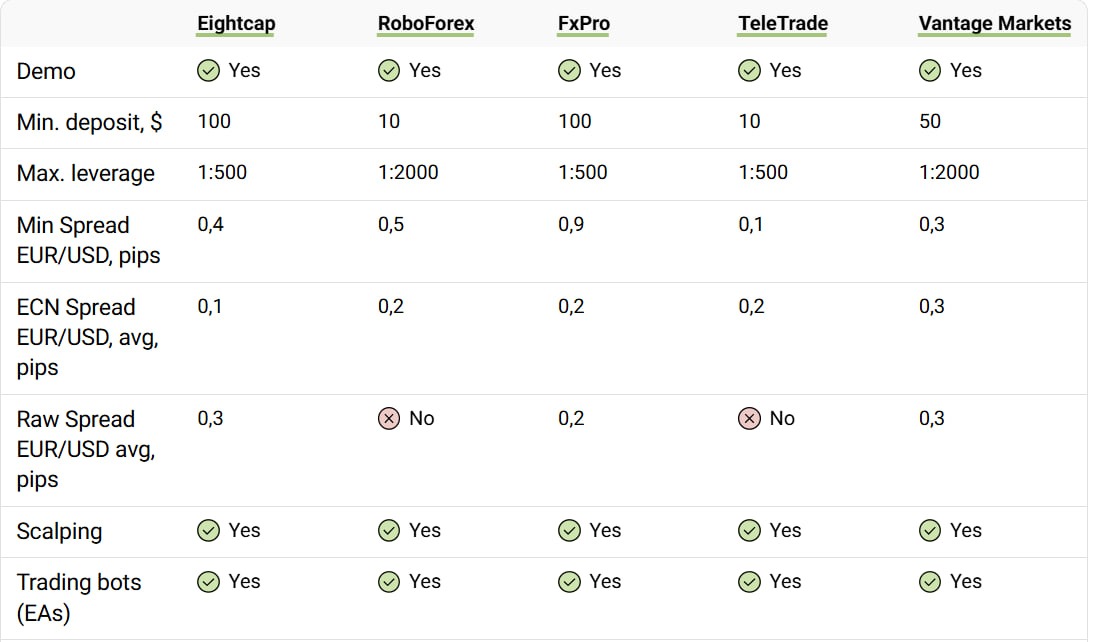

After choosing a trading strategy, it is important to test it on a demo account, and then on real trading. For this purpose, we have selected several brokers that are convenient for implementing and testing your strategies. These companies provide high-quality brokerage services and a wide range of trading instruments such as stocks, bonds, cryptocurrencies and other equally interesting offers.

Conclusion

Success in Forex trading is achieved through a combination of proper strategy, effective risk management and continuous learning. Therefore, analyze your results and adapt your approaches depending on market conditions - this will help improve your trading performance.

Effective use of Forex trading strategies requires the trader to be constantly up to date. Follow market news, learn new analysis methods, and don't be afraid to make changes to your strategy. Continuous development and adaptation to changing market conditions will help you achieve stable results and maximize profits.

Regardless of the chosen strategy, it is important to follow the rules of money management and set clear limits on losses. This will help to avoid significant losses and maintain the stability of the trading process, even in conditions of high market volatility.

Post a comment